Creative services such as advertising, publishing, and design are an important part of global trade. Their rise has been partly due to technology, which has made it easier to trade intangibles, but also because of increasing integration into the production of manufactured goods. In the decade before the pandemic, cross-border trade in services increased 60% faster than trade in goods.

In a new AHRC-funded Creative PEC project, published in Regional Studies, we are using data from the Inquiry in International Trade in Services (ITIS), in combination with the Annual Business Survey (ABS), to provide new evidence on the scale, trends, and geography of UK creative service exports. Second, we develop a measure of industrial relatedness between exports of creative, non-creative services and manufacturing goods to investigate the frequency with which they co-locate with other parts of the economy.

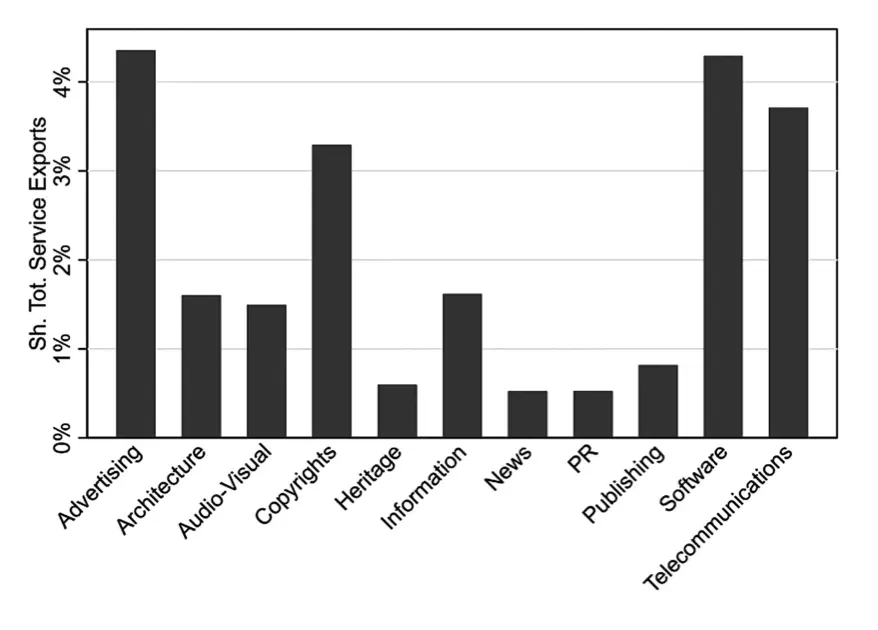

Creative services are a diverse group. The largest part of service exports come from Software, Telecoms, Advertising and Copyrights (copyrighted literary works, sound recordings, films, television programmes and databases). Together these account for around 15% of total UK service exports. As figure 1 shows, other services such as architecture, audio-visual and information also play a role.

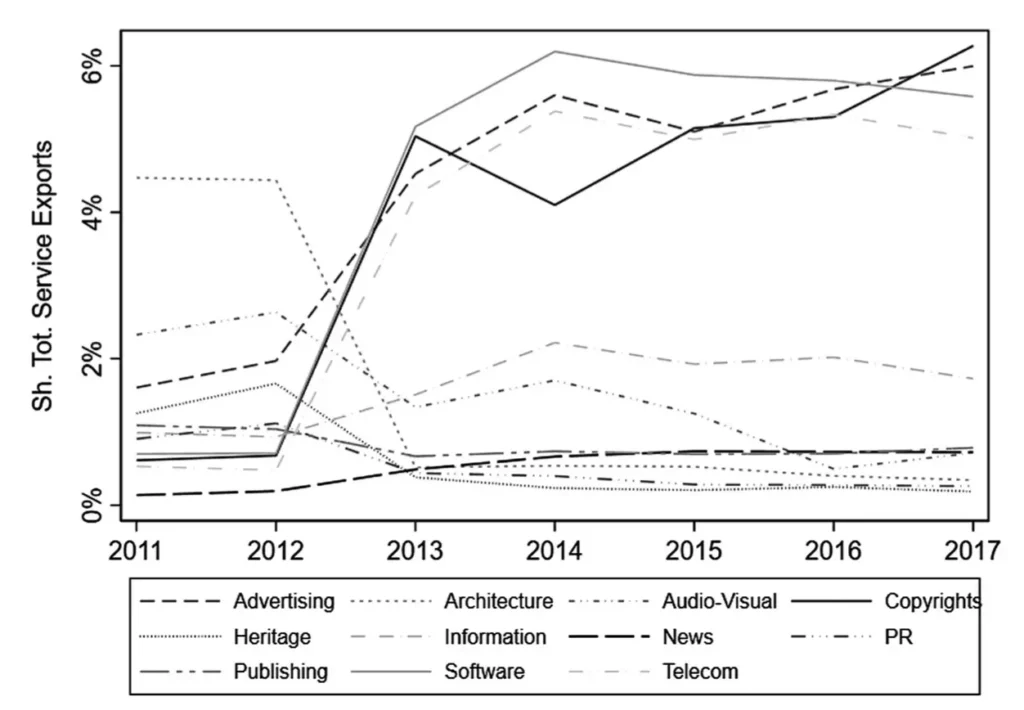

There has been considerable change in the export propensity of these sectors over time. Exports of advertising services, copyrighted creative works, telecommunication services, and computer software have been particularly important, accounting for around 5% of total services exports each. There has been a rapid increase in the share of services in four of the sectors which form the top 10: copyrights, advertising, software and telecommunications, while a relative decline in the share of architectural and audio-visual services exports.

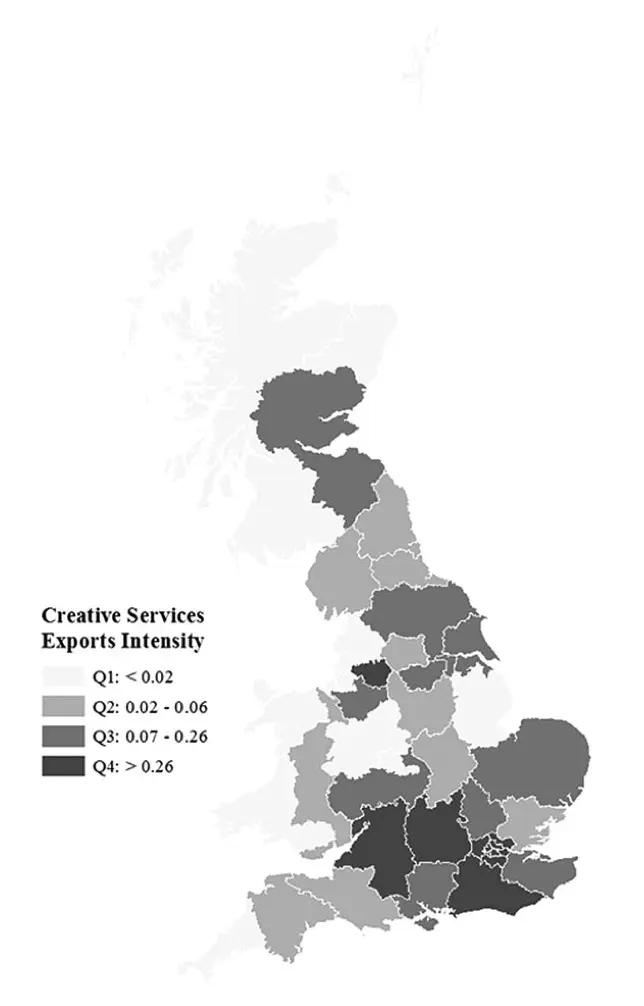

Creative service exports are highly geographically clustered, particularly in London and the South-East, Oxfordshire, Greater Manchester and Yorkshire. This partially reflects the geographical distribution of creative industries. The South-East and London account for around 40% of creative industry employees and a third of creative businesses, so it is hardly surprising that this is where most creative service exports come from.

Where do these exports go?

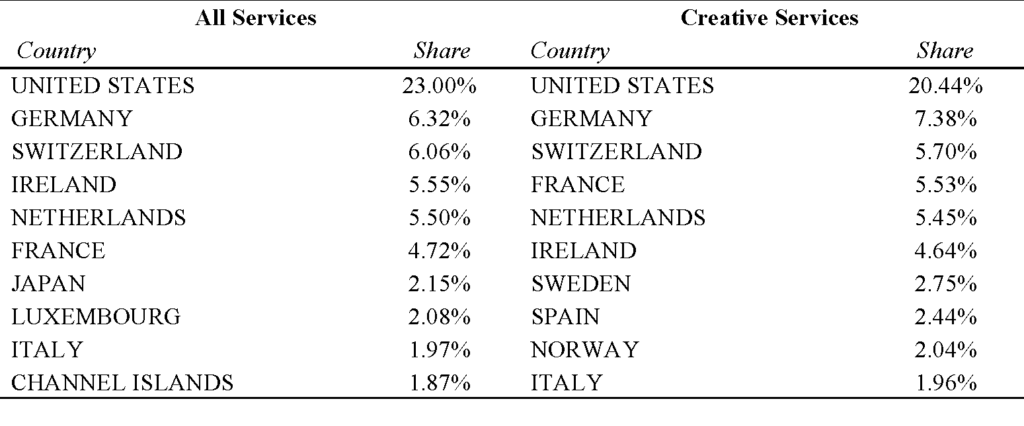

The largest share of UK creative service exports go to the United States, with over a fifth heading there. Germany, France and other EU countries are also well represented – although there is also considerable trade with Switzerland and Norway. Our data only goes to 2017, so won’t have accounted for the impact of Brexit – but they do show a problem for UK policymakers with EU (and EU linked) destinations so important.

Future Creative Service Growth

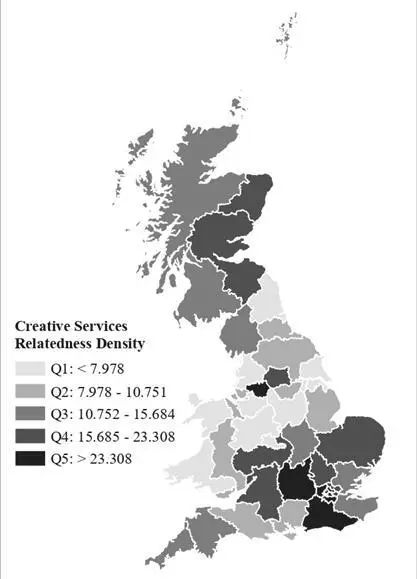

We also show relatedness between creative services exports and the rest of local industrial structure in figure 4, above. This shows the type of environments which might be suitable for future creative service growth, and the type of industries with which they tend to co-locate (potentially giving information on local input-output links). Creative service exports are particularly well suited to urban areas (London, Manchester, Edinburgh, Leeds) and hubs of knowledge creation (East Anglia, Oxfordshire, Surrey, Sussex and Warwickshire). These are places where clusters of universities and knowledge intensive industries could play a key role in fostering the growth of creative services.

Existing comparative advantage in manufacturing and other services exports could allow regions to diversify away from mature industries and specialize in new creative services.

Creative services have become increasingly important part of international trade. Future developments in ICT and innovation in digital services are likely to make the sector even more important in the future. As a key strength of the British economy, laying the conditions for creative services to continue their export success will be an important part of any future UK growth strategy. If the UK is to succeed as a trading nation, creative service exports will need to play an important role.

__________________________________________

Thumbnail image by Lars Kienle on Unsplash

Hero image by Mario Caruso on Unsplash

Related Blogs

Creative Corridors: Connecting Clusters to Unleash Potential

Introducing the Creative Corridors framework.

Creative UK Access to Finance Survey: Share Your Views

Professor Hasan Bakhshi, Director Creative PEC and Josh Siepel, Research Lead, R&D, Innovation a…

Unlocking the power and potential of the U.S. creative industries

Cellist Yo-Yo Ma in conversation with Upstart Co-Lab Founding Partner Laura Callanan at “Inves…

Reflecting on a year of State of the Nations reports

We’ve now published a full cycle of our new ‘State of the Nations’ series – which use th…

Copyright protection in AI-generated works: Evolving approaches in the EU and China

Prof Kristofer Erickson discusses the different approaches the EU and China have taken in response t…

Introducing the World Creativity Organization

Edna dos Santos-Duisenberg (member of Creative PEC's Global Creative Economy Council) & Lucas Foster…

Island in Transition: The Journey from Reggae Music Mecca to Creative Economy Hub

Andrea Dempster Chung, Co-founder and executive director of Kingston Creative A blog from Creative P…

UK engagement in Central Asia: Education and the creative economy in the territories of the ‘new Silk Roads’

Dr Martin Smith and Dr Gerald Lidstone look at the history of the British Council's work in Central …

Creative Industries in Egypt: An Overview

Omar Nagati – GCEC Member and Co-Founder of CLUSTER – outlines the findings of a study into the crea…

Introducing the Global Creative Economy Council (GCEC)

Hasan Bakhshi and Rehana Mughal explain what the GCEC is trying to achieve and how the network will …

Global Creative Economy Council: An introduction from the Chair

John Newbigin introduces Creative PEC's Global Creative Economy Council

Creative PEC’s response to the Spring Budget 2024

Creative Industries in the 2024 Spring Budget The creative industries are a significant part of the …