The Equity Gap in Britain’s Creative Industries[1].

by Professor Nick Wilson

The creative industries are significant contributors to the UK economy and to intellectual exports. However, underlying this vibrant growth is a concerning paradox: a funding challenge, a shortfall in the provision of patient capital (equity finance) that poses a threat to this development and expansion.

Equity investment plays a crucial role in the transformative development of start-ups into large-scale enterprises and is frequently associated with high-technology and knowledge-intensive ventures, where the risk, timing to commercialisation, and the scale of returns are challenging for lenders to evaluate. Moreover, founders of potential high growth businesses are either unfamiliar with the type of investment, reluctant to dilute their shareholding and/or to share their innovative ideas. The equity finance market fails to provide optimal funding for individual firms and the sector as a whole. The UK’s creative sector, contributing over £115 billion annually to the economy, supporting 2.3m jobs is likely undercapitalised. While commentators extol the virtues of the “creative economy,” young firms find themselves locked out of the equity markets necessary for scale. Unlike biotech or fintech, creative enterprises often struggle to translate intangible assets—ideas, brands, cultural value—into the calculus of venture capital. The challenges for investors include forecasting revenue streams and scalability, and the valuation of intangible assets and IP, suggesting a significant knowledge gap between investors and creative businesses. Investors may lack understanding of the creative process and market dynamics, the public good nature of some creative outputs and the wider non-profit objectives and spillovers, leading to information asymmetry and market failure (Bakhshi et al 2025; Wilson et al 2018).

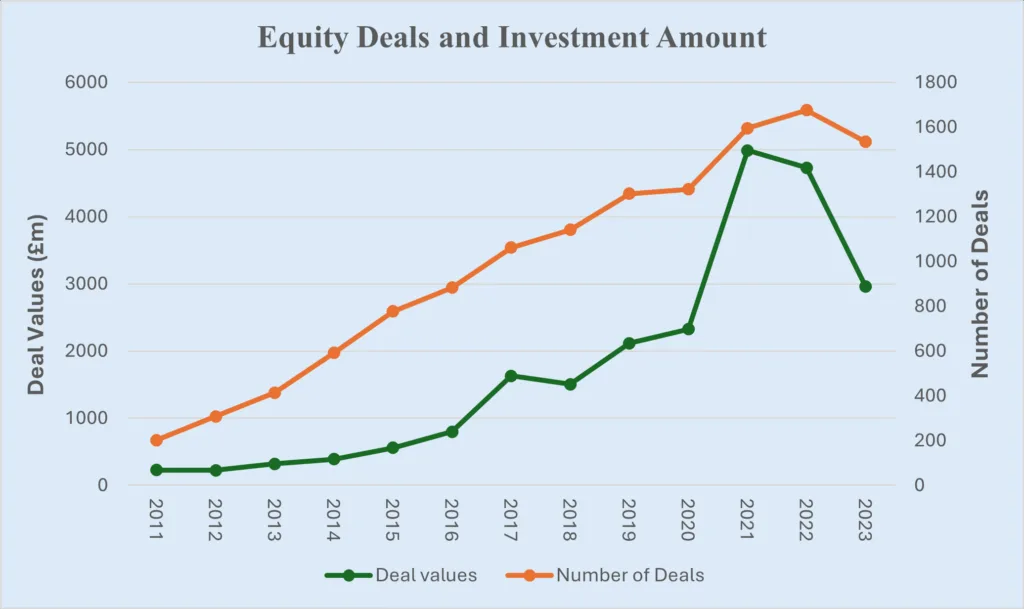

Analysing the population of UK private companies, we estimate that there are around 180,000 firms that fall within the creative industries sector [2] and in the last decade (2013-2023) there have been over 13,000 equity finance deals amounting to over 23bn in funding, around £3bn in 2023. Figure 1 tracks the trends in deals and amounts, the subsectors (based on DCMS SIC Codes) IT, Film and TV and Music (performing arts) attract over 75% of the total investment. Yet, we estimate, that there is a significant shortfall in funding, a current ‘equity gap’ in the region of £3.1bn of potentially unmet demand.

Sectors: Advertising and Marketing; Architecture, Crafts; Design; Film and TV; IT, software and computer services; Publishing; Museums and Galleries; Music and Performing Arts

Equity Finance and Funding Gaps

Equity investors are instrumental in fostering innovation and growth, providing essential support to companies at various stages of development, from nascent startups in the seed stage to more established enterprises seeking growth capital. Through mechanisms such as venture capital, private equity, angel investment, and crowdfunding platforms, equity financing characterized by ‘patience’ facilitates the transformation of innovative concepts into viable businesses. However, a significant challenge persists, numerous high-potential companies in the United Kingdom, particularly those in technology-intensive, knowledge-driven, and rapidly expanding sectors, continue to face difficulties in securing necessary funding. This disparity between the strong demand for capital and the inadequate supply is commonly referred to by experts as the “equity gap”. Our reported estimates (Wilson and Kacer 2025) suggest that overall, for all knowledge intensive and high technology sectors a potential short fall of some £10bn to £17bn in each of the years from 2017 to 2023 with the gap widening. Moreover, there are significant regional disparities with the Midlands (West and East) and Yorkshire and Humberside having the largest gap between demand and supply. This persistent issue results in many promising ventures being underfunded or stalling before they can achieve scalability. Analysis of the creative sector exhibits similar regional disparities and our estimates of the overall equity gap suggest a maximum shortfall of around £3.1bn in 2023.

In order to arrive at our estimates of the extent, nature, and potential causes of regional disparities in equity finance investments, we conduct a series of analyses utilizing comprehensive datasets on private companies and individual equity finance transactions within the UK company sector for the period 2011-2023. This aims to model potential demand for patient capital in the UK company population (demand) in relation to the actual investment (supply). We have constructed a detailed longitudinal database of UK business characteristics (financial, non-financial, governance data) and actual funding to estimate the magnitude of the equity finance gap by sector, region and investment stage. The dataset comprises 24.5 million company-year observations, over 54,000 individual equity deal records, and more than 40 variables capturing firm-level, sectoral, and regional characteristics for inclusion in the estimated econometric models. To assess the potential unmet demand for equity finance, we identify companies that exhibit characteristics similar to those that have successfully obtained equity finance. This analysis employs a propensity score matching methodology to delineate the attributes of firms that have accessed equity finance. Subsequently, we utilize these identified characteristics to pinpoint potential targets for equity investors within the company population. Upon identifying the target firms, we can impute potential deal values for each of these targets, basing our estimates on the characteristics of known deals. The aggregate of these deal values constitutes the estimate of the potential additional demand for equity finance (i.e., the ‘equity gap’) when compared with actual investments in each region. Regions and sectors are then ranked according to the magnitude of the potential equity gap. Regionally the ranking of funding deficits from largest to lowest are Yorkshire, E.Midlands, S.West, N.West, Wales, S.East, Scotland, East England, N. East, N. Ireland, London. When we adjust the estimates, based on government access to finance surveys, to take account of the fact that many firms are reluctant to fund their businesses with external equity and that a high proportion of applicants for funding are rejected, we still observe a significant potential gap in funding of up to £0.5 to £1.4bn in the creative industries in 2023.

Our latest research continues to highlight two stubborn issues: the equity gap hasn’t gone away, and regional disparities in access to funding still run deep. If the UK wants to unlock the full potential of its startup ecosystem and innovative growth, closing these gaps will be essential.

[1] A more detailed paper, “Equity Finance for Innovative Growing Businesses: Trends, Equity Gaps and the Creative Industries” (Wilson N and Kacer M 2025) is available on SSRN.

[2] We identify ‘active’ companies within the Creative Industries SIC codes from our company population data base. Active companies are registered companies that have filed accounts at Companies House with evidence of assets and trading activity.

References

Bakhshi, H. Siepel J., Carmona, L. and Tarr, A. (2025) Unleashing Creativity: Fixing the finance gap in the creative industries, Creative Industries Policy and Evidence Centre

Wilson, N., & Kacer, M. (2025). “Equity Finance for Innovative Growing Businesses: Trends, Equity Gaps and the Creative Industries” forthcoming available on SSRN.

Wilson, N., & Kacer, M. (2024). Equity Finance for Start-up and Growing Businesses: Recent Trends. doi:10.2139/ssrn.4657150

Wilson, N., Wright, M., & Kacer, M. (2019). Equity Finance and the UK Regions Understanding Regional Variations in the Supply and Demand of Equity and Growth Finance for Business. https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/821902/sme-equity-finance-regions-research-2019-012.pdf

Wilson, N., Kacer, M., & Wright, M. (2018). Understanding Regional Variations in Equity and Growth Finance: An Analysis of the Demand and Supply of Equity Finance in the UK Regions. doi:10.2139/ssrn.3252346

Wilson, N., Wright, M., & Kacer, M. (2018). The Equity Gap and Knowledge-based Firms. Journal of Corporate Finance, 50, 626-649. doi:10.1016/j.jcorpfin.2017.12.008