The UK’s creative industries – from film to fashion, and from video games to the performing arts – are integral to local communities throughout the country. This is in part because of the economic importance of the sector: one in eight UK businesses are part of the creative industries, and together they contributed almost £116 billion in GVA in 2019, growing twice as fast as the rest of the UK economy as a whole in the past decade (DCMS, 2021).

Yesterday’s Spending Review therefore appropriately highlighted the creative industries’ importance to the UK’s economy and wellbeing, and aimed to support the sector through investment and policy initiatives. In particular, it offered support to the arts and cultural sector (for example, through temporary rate uplifts to the Theatre, Orchestra and Museums & Galleries Exhibition tax relief).

This is much needed, as evidence indicates this has been one of the areas of the economy worst impacted by the pandemic. However, there is still more to do – there was nothing on how the Government will address the particular needs of freelancers that the PEC and others have highlighted, the talent needs of the creative sector in the light of changing migration patterns, and on the importance of recognising the Arts, Humanities and Social Sciences in R&D so that R&D tax reliefs are fully fit for purpose.

Here, we highlight those areas where we have published evidence that policy intervention could support growth in the creative industries (summarised in our representation the Treasury), and report on whether this Spending Review addresses our recommendations.

Innovation-led recovery: R&D & Artificial intelligence:

In our submission, the PEC called for an R&D tax relief system that was more inclusive for creative sectors.

Our recommendations included:

- Creative firms would benefit substantially from more targeted advice from the HMRC, with specific guidance, supported by case studies and schematics, as to what does and does not constitute qualifying expenditure in creative industries R&D.

- Targeted training should be given to HMRC tax inspectors on how to distinguish between qualifying and non-qualifying expenditure in the case of creative industries R&D.

- The Government should amend its definition of R&D for tax relief purposes so that it follows the OECD’s Frascati Manual in recognising R&D in the Arts, Humanities and Social Sciences (AHSS), bringing the definition into line with the large number of countries that already do so, including Austria, France, Germany and South Korea.

- BEIS should drop the explicit exclusion of AHSS projects from its guidance, and thereby acknowledge that the definition of ‘science’ includes the systematic study of the nature and behaviour of the physical and material universe, humankind, culture and society

We also recommended that the Government support an AI and Creative Industries Centre within the context of its broader AI ambitions, to provide: training and skill development in AI for the creative industries, a gateway to research and development (R&D) in AI for the creative industries and commercial development for AI creative startups

The Spending Review announced:

- To ensure the R&D tax reliefs continue to support cutting edge R&D methods, the Government will expand the list of qualifying expenditures to include data and cloud computing costs. While this will benefit digital creative businesses whose R&D meet HMRC’s existing qualifying criteria, no acknowledgment is given to calls by industry to include AHSS-related R&D activities as within scope of tax relief. The PEC will continue to make the case for AHSS R&D, which is of disproportionate importance to the services sectors including the creative industries, which between them make up 80% of the UK’s economy.

- Continued support for investment in artificial intelligence is recognised in the Budget, highlighting that AI is one of the priorities agreed by the Prime Minister’s new National Science and Technology Council. Alongside an ambitious policy increasing R&D funding, this presents a significant opportunity to invest in creative AI, as recommended by the PEC.

UK-wide investment

The PEC’s representation to the Spending Review highlighted a raft of research which investigates how the creative sector can help the UK Government to ‘level up’ the UK economy – both in terms of the economic growth of different areas, and in terms of improving how people feel about the places they live in.

The Spending Review explains that ‘a variety of frameworks have been used to understand local disparities in economic outcomes’. This is welcome, and we would like to have seen support for the inclusion of cultural and heritage capital when understanding regional disparities. This is particularly vital because, as described in the Spending Review, ‘there is considerable variation in economic outcomes across the UK and narrowing these could have a significant positive impact on the UK economy.’

In this context, HM Treasury’s support for DCMS’s Cultural and Heritage Capital framework project which aims to put public investment in culture and heritage on the same evidence-based footing as natural capital is important.

Our recommendations included:

- Continued support for the AHRC-led Clusters+ programme and their sector-wide infrastructure investment

- Recognition of the needs of the creative sector in the Levelling Up Fund and other business support funds

The Spending Review announced:

- The importance of cultural assets are recognised as part of this Government’s Spending Review investment, particularly in terms of their importance in ‘restoring local pride’.

- The Government will provide £14 million in each year of the SR21 to support the creative industries, including supporting SMEs to scale up and providing bespoke support for the UK’s independent film and video game industries.

- The first round of Levelling Up funding will benefit select cultural projects across the UK including the Theatr Bryndcheiniog Arts Centre in Brecon which will get a cut of Wales’ £121m allocation, and the £150m Community Ownership Fund which will help locals of Whithorn in Scotland acquire and develop the Old Town Hall into a museum.

- The Budget and Spending Review also maintain funding for the UK City of Culture programme.

Creative workforce: Supporting Self-Employed creatives, Social Mobility, & Immigration

Our recommendations included:

- The government should appoint a freelancer commissioner to address some of the systemic challenges faced by self-employed people across Whitehall departments.

- We highlighted a need for migration routes adequate for creative industries freelance practitioners.

Our evidence also pointed to a need to ensure fair and equal access to culture and creative education as a great leveller.

The spending review announced:

- A variety of visas better suited to self-employed people, including the Scaleup, High Potential Individual, and Global Business Mobility visas (launching Spring 2022). We still need clarity on how these will work for areas like design, which are highly reliant on freelancers. However, it contained no initiatives, like a freelancer commissioner, which would aim to address some of the systemic issues faced by self-employed workers.

- A previously announced £270m pupil premium for arts education was notably absent from the Spending Review, leading to sectoral concerns that this investment may no longer be a commitment.

- However, the Spending Review does provide a new package of £1.8 billion to help schools to deliver evidence-based approaches to support the most disadvantaged pupils and more learning hours for 16-19 year-olds, which will inevitably help the creative sector alongside all other areas of the economy.

- Total spending on skills will also increase over the Parliament – by £3.8 billion by 2024-25 – equivalent to a cash increase of 42% (26% in real terms) compared to 2019-20. This funding will quadruple the number of places on Skills Bootcamps, expand the Lifetime Skills Guarantee on free Level 3 qualifications, and improve numeracy skills through the new Multiply programme. This is in addition to providing extra classroom hours for up to 100,000 T Level students. SR21 also confirms funding to open 20 Institutes of Technology and for upgrades to the Further Education college estate across England.

Related Blogs

Taking stock of the Creative Industries Sector Plan

We summarise some of the key sector-wide announcements from the Creative Industries Sector Plan.

Why higher education matters to the arts, culture and heritage sectors

Professor Dave O’Brien, Professor of Cultural and Creative Industries at University of Manches…

What does the 2025 Spending Review mean for the creative industries?

A read out from Creative PEC Bernard Hay and Emily Hopkins On Wednesday 11th June the UK Government …

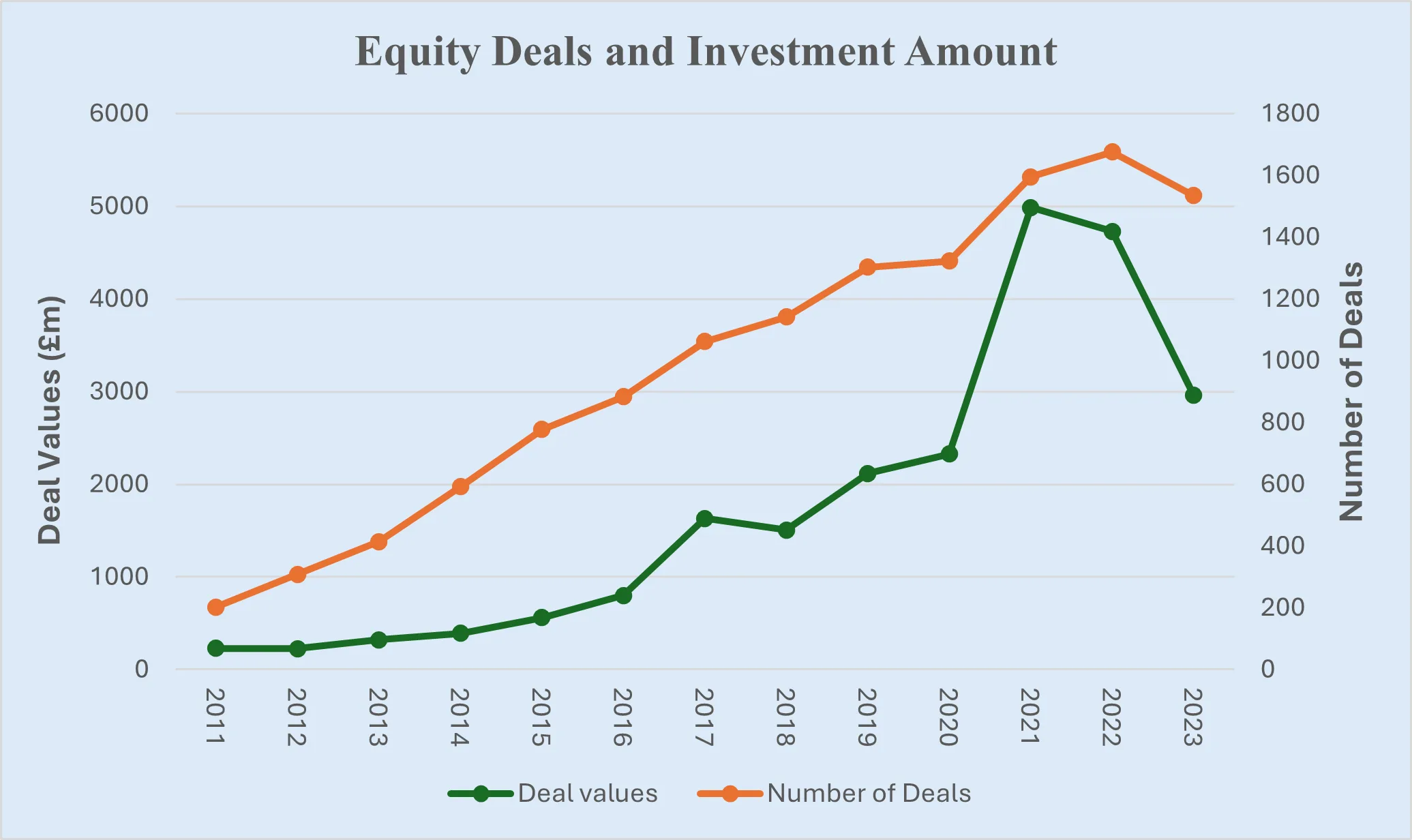

Bridging the Imagination Deficit

The Equity Gap in Britain’s Creative Industries[1]. by Professor Nick Wilson The creative industries…

Why accredited qualifications matter in journalism

Journalism occupations are included on the DCMS’s list of Creative Occupations and, numbering around…

All Together Now?

Co-location of the Creative Industries with Other Industrial Strategy Priority Sectors Dr Josh Siepe…

The Mahakumbh Mela, India, 2025

The festival economy: A Priceless Moment in Time Worth GBP 280 Billion in Trade Jairaj Mashru looks …

Class inequalities in film funding

Professor Dave O’Brien, University of Manchester, Dr Peter Campbell, University of Liverpool and Dr …

Creative self-employed workforce in England and Wales

Dr Ruoxi Wang, University of Sheffield and Bernard Hay, Head of Policy at Creative PEC Self-employed…

What just happened to funding for culture in Scotland?

First the facts: Creative Scotland announced the outcome of its new Multi-Year Funding Programme on …

Copyright and AI – a new AI Intellectual Property Right for composers, authors and artists

Background The new technology landscape emerging from the super rapid progress in developing AI, Gen…