The Levelling-Up White Paper produced by the Department for Levelling-Up, Housing and Communities notes that ideas and innovation are key drivers for rebalancing the economy.

Since 2018, UKRI’s £56.8m Creative Industries Clusters Programme (CICP) has been investing in Creative Industries research and innovation. We have funded nine Creative Research and Development Partnerships (CRDPs) across the UK. Each partnership is hosted by a university and includes more than a hundred businesses – SMEs; large companies; start-ups and micros along with local and national partner organisations – who work together to co-design a place-based innovation strategy relevant to the specific needs of the cluster.

Our aim was to test the theory that turbocharging Research and Innovation (R&I) within an established creative cluster would drive measurable economic growth.

We aimed to do this by:

- raising the number of businesses participating in research and development (R&D) by providing access to research expertise

- increasing the capability of creative firms to develop new products, services and experiences through R&D

- providing access to innovation infrastructure and facilities

- driving third party investment into clusters and businesses through de-risking private capital by the deployment of public R&D funds

Meeting these objectives required a bespoke model for the programme – adapting funding models and developing new ones. The model seems to be working, with the CRDPs collectively generating £213m of co-investment so far. For every £1 spent by UKRI, the programme has so far raised a further £3.80 largely from the private sector. We have also delivered 900 business R&D projects (creating new products, experiences, and processes that give regional businesses a competitive advantage or a chance to scale-up), engaged more than 2500 businesses and 60 Research Organisations and delivered skills training to 2,300 creative professionals.

Listed below are the key components of the CICP model which independent evaluators believe were critical in the success of the programme so far. Hopefully an insight into this model will help guide towns, cities and regions who see investment in innovation and the Creative Industries as a driver of future growth.

1 – Universities offer more than education and research publications

As cluster ‘leads’, universities play a central role in the CICP model. While they are obvious providers of talent and expertise (students, alumni, lecturers, and a rich research community) and can invest in or provide access to research and innovation infrastructure (studios, equipment, office space), their significance is their ability to act as cultural and sector brokers in a place. This can’t be taken as read for all institutions but where the talent, strategic understanding and commitment exist, or can be developed, the universities’ role as a convenor is vital.

Businesses benefit from the multiple disciplines and multiple solutions that can be provided through university networks, for example industry can access expertise from a business or psychology department or might ask a university to source advice on intellectual property contracts. The Creative Industries being ever more closely intertwined with technology means that access to creatively engaged STEM, design and technology disciplines is very important.

Our existing clusters typically involve more than one university and perhaps even universities who traditionally competed with one another. We have found they can work together to offer complementary knowledge, expertise, and resources to meet mutual cluster goals.

2 – Partnerships and collaboration maximise impact

Our clusters are partnerships, formed during the application process and developed through the Programme’s delivery phase.

At the outset the universities who had to lead the application for funding had to show they were engaged with industry and demonstrate that they had collaborated with cluster partners to develop a strategic vision. Since launch, every CRDP has increased its industry network, through funding programmes, networking events, targeted missions, or challenge interventions. As the industry network grows, so too does the intel into the entire cluster, fine tuning a place-based research and innovation strategy. Clusters will usually have a small number of large firms and many small and micro companies, reflecting the business demographic of the creative industries sector generally but their own place and sector specifically.

As evidence of impact has built, Local and Combined Authorities, devolved Governments, LEPs and economic development agencies have become ever more engaged with the cluster parterships. They too act as large-scale brokers but also offer investment directly into the innovation cluster or by offering capital assets within their region. Quite often those regional public bodies do so because creative industries form a part of their strategic social or economic objective.

3 – Devolving the Geographical Footprint

Post award of funding, each partnership has been responsible for defining its exact geographic footprint. We have not set this centrally. While local or combined authority borders may act as a guide, the cluster parameters can also be set by the geographical priorities and location of key strategic partners or innovation assets. By allowing CRDPs to define their own parameters, we give them the negotiating power needed to gain commitment from key strategic partners. These partnerships increase co-investment and maximise the impact for the cluster, for example growing cluster networks and capacity, and beyond the cluster such as dissemination of new knowledge and skills into the sector .

This is important for the future as we look to develop the model. Successful clusters lead the way for nearby regions and places. The success of the CICP university/business partnership R&D model could also suggest its use by Local and Combined Authorities making applications to the UK Shared Prosperity Fund or the Department for Digital, Culture, Media and Sport’s Create Growth Programme.

4- Devolving Funding Decisions

We also devolved significant financial decision making to the CRDPs. The Partners were able to decide on financial priorities as well as R&D programme design, determined by the particular circumstances of the cluster and region.

This means that each CRDP can learn and develop from trying out intervention models and seeing whether they deliver the desired impact rather than being restricted to a set framework. Funding the clusters on a five-year model really helped. This allowed clusters to do bespoke local analysis of what works – as the workforce and businesses grow, develop and pivot in the face of changing market and economic circumstances.

Our Challenge team work with the CRDP Directors to carefully consider the ‘types’ of R&D programmes that might meet the needs of each cluster. Analysis of different types of R&D models is starting to deliver an overarching theory on which intervention best suits a particularly desired outcome. Take the example of a Lead Customer Challenge which is a funding call to small companies sponsored by a large organisation, where the innovation challenge is set by the sponsor and the innovation result impacts the supply chain. It has proved highly successful for enabling SME creative businesses to expand opportunities, gain access to global markets, and drive rapid company growth.

5 – Create a Space for Clusters to Connect

We have also created a space for the nine CRDPs to connect virtually and in-person, breaking down barriers of regional competitiveness and opening the doors for greater collaboration. The CRDP s are working in collaboration to overcome national sector challenges or to share resources, including knowledge, that are mutually beneficial for each region. The overall significance is that there is now a network of strong innovation clusters that are collectively, as well as independently, working towards strengthening the future value of the Creative Industries across the UK.

Conclusion

Central Government, including the Department for Levelling Up, Housing and Communities, is clear that ideas and innovation are a key component for its levelling up strategy. The CICP is testament to that claim:

- It has drawn co-investment four times greater than the original business case and we’re likely to see more in the remaining 18 months of the programme.

- Multi-million pound follow on funding is going into regions as a direct result of the programme including media.cymru (generated by Cardiff’s Clwstwr), My World (generated by Bristol+Bath R&D Partnership), the newly established Leeds Institute of Textiles and Colour (generated by Future Fashion Factory), and Fashion Textiles and Technology Institute (established by the BFTT partnership)

- The co-investment we are generating is not exclusive to research and innovation, it benefits the entire Creative Industries regional eco-system – R&D to supply chain, skills, talent development, growth finance, and business support. For example, a recent review found university partners had developed 54 new courses, modules, and skills programmes based on their new knowledge of R&D. We didn’t fund them to do this, they made their own investment based on the new expertise developed.

To quote a CICP Advisory Board member “you seem to have created a landing strip for other people’s money”. What is clear is that the success of the CICP is due to the specific way in which it has been delivered: building partnerships, facilitating networks, and devolving powers.

_________________________________________

Image credit: XR Stories

Related Blogs

Taking stock of the Creative Industries Sector Plan

We summarise some of the key sector-wide announcements from the Creative Industries Sector Plan.

Why higher education matters to the arts, culture and heritage sectors

Professor Dave O’Brien, Professor of Cultural and Creative Industries at University of Manches…

What does the 2025 Spending Review mean for the creative industries?

A read out from Creative PEC Bernard Hay and Emily Hopkins On Wednesday 11th June the UK Government …

Bridging the Imagination Deficit

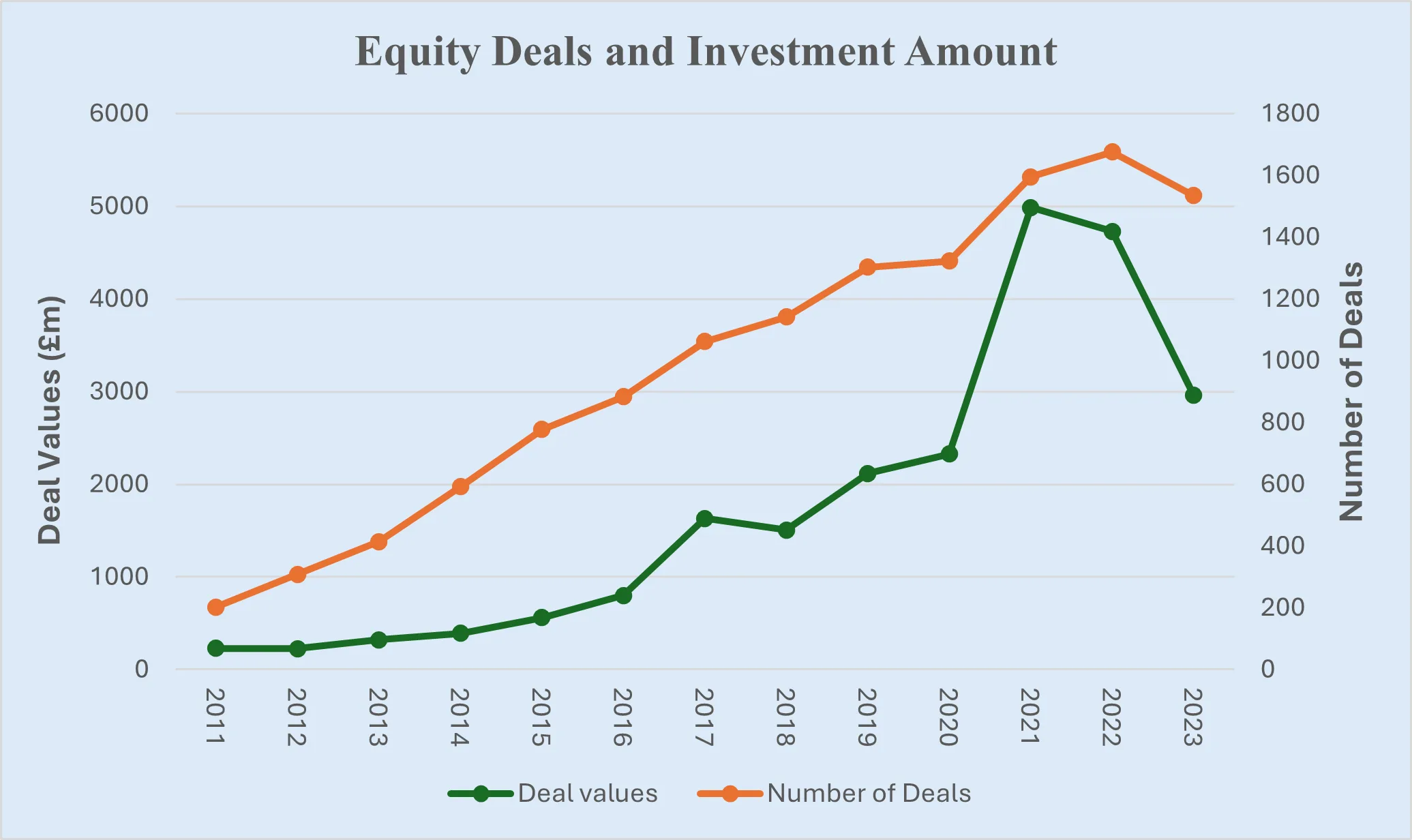

The Equity Gap in Britain’s Creative Industries[1]. by Professor Nick Wilson The creative industries…

Why accredited qualifications matter in journalism

Journalism occupations are included on the DCMS’s list of Creative Occupations and, numbering around…

All Together Now?

Co-location of the Creative Industries with Other Industrial Strategy Priority Sectors Dr Josh Siepe…

The Mahakumbh Mela, India, 2025

The festival economy: A Priceless Moment in Time Worth GBP 280 Billion in Trade Jairaj Mashru looks …

Class inequalities in film funding

Professor Dave O’Brien, University of Manchester, Dr Peter Campbell, University of Liverpool and Dr …

Creative self-employed workforce in England and Wales

Dr Ruoxi Wang, University of Sheffield and Bernard Hay, Head of Policy at Creative PEC Self-employed…

What just happened to funding for culture in Scotland?

First the facts: Creative Scotland announced the outcome of its new Multi-Year Funding Programme on …

Copyright and AI – a new AI Intellectual Property Right for composers, authors and artists

Background The new technology landscape emerging from the super rapid progress in developing AI, Gen…