The creative industries are one of the fastest growing sectors of the UK economy. One in eight UK businesses are part of the creative industries, and together they contributed almost £115.9 billion in GVA in 2019, growing four times faster than the rate of the UK economy as a whole.

But this growth and value needs to be supported. We know that creative firms struggle to win investment for their research and development. This type of funding is crucial for businesses that are competing and growing in fast moving, technologically driven, markets. This isn’t helped by the lack of a clear definition for what we mean by ‘innovation’ in the creative industries, which makes it challenging to design new financial levers, such as R&D tax relief policies .

Despite these challenges, there is lots to be positive about. At the start of February, DCMS announced a further £50 million funding for creative businesses as part of their Creative Industries Sector Vision. And at the start of the year the government announced a significant increase in public R&D spend across the entire economy. Indeed, the Government has identified the Creative industries as one of four key sectors in the Plan for Growth to encourage recovery following the pandemic. To make sure this recovery and growth happens, it is vital that the creative industries receive a fair share of all future innovation investment.

This week the PEC is publishing research that looks at the barriers to achieving R&D funding, case studies of specific creative sub-sectors, such as museums and galleries, and some of the policy and financial levers that we need to start pulling if we want the creative industries to remain competitive and valuable as we emerge from Covid-19.

Download this policy brief to get a quick primer on everything you need to know about R&D in the creative industries, and have a look at the rest of the research and blogs we are publishing between 14th – 18th February.

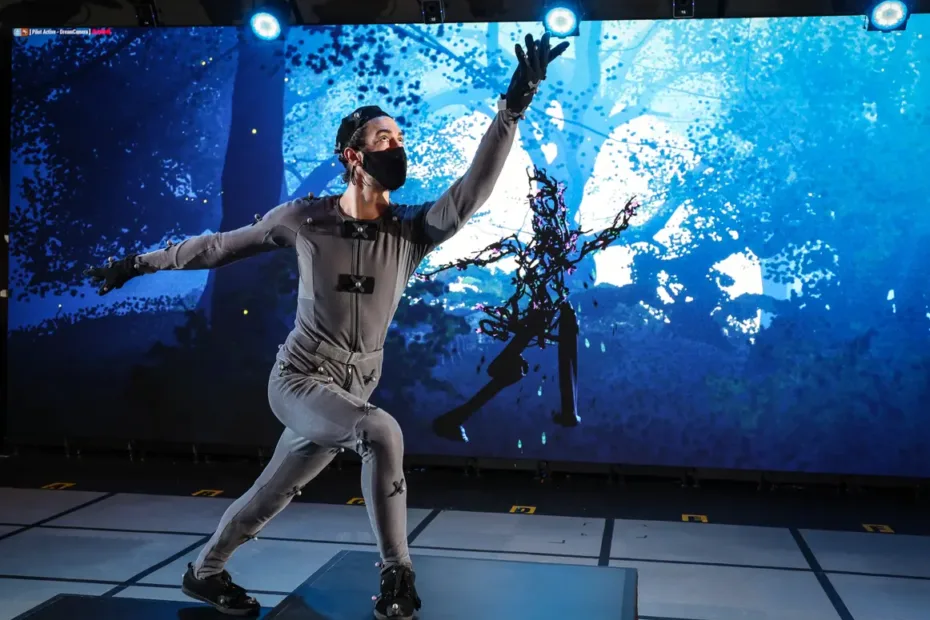

Image credit: Royal Shakespeare Company and Stuart Martin

Related Policy Briefings

Harnessing the growth potential of createch

This insights paper summarises existing evidence on the present opportunities and challenges in crea…

Policy Brief: Creative Industries Employers’ Perspectives on Skills Initiatives: 2025

Overview The Government’s new Industrial Strategy sets a long-term, sector-focused approach to skill…

Policy Brief: Migration in UK Creative Occupations and Industries

Overview The UK’s creative industries are internationally oriented, a fact that’s reflected in its e…

Policy Brief: Arts, Culture and Heritage: Recent Trends in UK Workforce and Engagement in England

Overview Five years after the Covid-19 pandemic, engagement and employment in the arts, culture and …

Policy Brief: Foreign Direct Investment in the UK’s Creative Industries

Read the Policy Brief based on the most recent State of the Nations Report on FDI.

Policy Brief: Insights from the Northern Creative Corridor Workshops Sprint

The Northern Creative Corridor is an initiative aimed at connecting creative clusters across Norther…

Policy Brief: International Trade and the UK Creative Industries

This policy brief examines international trade in the UK creative industries. Drawing on our UK Trad…

Policy brief: Audiences and Workforce in Arts Culture and Heritage

This policy brief uses census data to provide, for the first time, a comprehensive analysis of audie…

Policy Brief: Transitioning to Sustainable Production across the UK Theatre Sector

This policy brief outlines recommendations for transitioning to more sustainable theatre production …

Authors’ Earnings in the UK

This policy briefing sets out areas for possible policy action, proposed by the researchers at CREAT…

Television production, international trade and pressures to consolidate

The UK television production sector is one of Britain’s leading creative export sectors. This briefi…

Three ways to support growth in the creative industries

Three ways to support growth in the creative industries The Creative Industries are an economic powe…