The COVID-19 crisis has generated an unprecedented level of economic disruption in a short space of time, with the nation’s economic activity having shifted essentially to a wartime footing against an invisible enemy. The creative industries have been particularly affected by these changes as substantial parts have had to go into hibernation. The impact on these sub-sectors could potentially be devastating, whilst on others (such as digital) it may look different. As such, government and trade groups are keen to understand how the creative industries are responding to the crisis, and what will need to be done to get them to bounce back quickly when the crisis eases.

A number of bodies have sought to engage in rapid data collection to understand the impacts on businesses. There are several challenges when trying to do these surveys, and in this post we give what we hope will be useful tips about how to approach survey design, based on years of experience of designing creative industries business surveys, including a major new survey on creative clusters later this year from the PEC.

1. Keep the survey short

The longer the survey, the more likely it is that people will abandon it before the end (if the survey is online) or decline to take part (if the survey is via telephone). While you want to collect enough information, the shorter you can make the survey, the better. Only ask what you really need to know.

2. Be persuasive but not pushy

If people understand why you’re conducting the survey and how it will help, they are more likely to participate. Take the time to explain this in the survey introduction and other communications. You have to be realistic about where research sits in peoples’ overall priorities at this difficult time. Most will be focusing on implementing business contingency plans and understanding/implementing government support measures, for example furloughing staff. We need to recognise this, accept that survey response rates will be lower than normal, and not push hard to persuade people to take part. Explain clearly what will happen to the results of the survey.

3. Maintain data privacy and security

Online survey platforms such as SurveyMonkey have made it extremely easy to produce online surveys, but it is very important to remember your legal and ethical responsibilities in collecting data. Respondents should be clearly informed of what they are being asked to do, what will happen to the data they provide, and who will be seeing it. This is particularly important if you are asking respondents for their names and contact details. Remember that if you are collecting data, General Data Protection Regulation (GDPR) will apply.

4. Be clear about what you want to know

A crisis like COVID-19 is multifaceted, and if there is an aspect that you are particularly keen to know about, be specific when you ask it. For instance, asking if a company “Are you satisfied with the government’s response to the crisis?” could be interpreted as asking for opinions on healthcare provision, social distancing, or business support. This means that other than as a measure of general sentiment, the results are less useful.

Focusing on the government’s response for businesses is more precise, and could be a better gauge of attitudes. For instance in a particular sector, you could ask “Are you satisfied that the government’s measures to help businesses in the crisis meet the needs of the XXX industry?”

If the aim is more specific still, one might ask “Are you aware of the government’s loan/grant offers to businesses? / If so, are you satisfied they meet the needs of the YYY industry?”

Any of the options above could work, but understanding what you want to know in advance will make drafting responses much easier and minimise any ambiguity in the data you collect.

5. Capture background information (but not too much)

Collecting profile data allows you to check whether those who completed the survey are representative of the overall population of creative industries firms, and also enables comparative analysis between key segments, which will allow you to see if there are particular types of firms that have been more severely impacted.

As a minimum, anticipate asking businesses:

- What they do (either sector or particular subsector)

- Number of employees (a useful proxy for size – you can either ask respondents for a number or for one of a range of options such as 0, 1-4, 5-9, 10-49, 50-99, 100-249, or 250+ employees

- Turnover (also a useful proxy for size, and much more easily responded to as part of a range)

- Location (how detailed may depend on what you are looking for – you could ask for regions, or for city, or for postal district e.g. BN1 for central Brighton or full postcode)

Having this information can also help you to ‘weight’ the data against the overall population from which you are sampling.

6. Remember freelancers

It’s well known that freelancers play a critical role in the creative industries. On Thursday 26th March, the Chancellor announced a range of measures to support self-employed and freelance workers. If you are looking to understand the impact of the crisis on the sector’s freelancers, it’s important to ask businesses how many freelancers they work with? (noting there may be seasonal patterns). Depending on the sector one could either ask firms how many they employed at the start of specifically January or February, say, or if there is typically substantial variation throughout the year, how many freelancers the company worked with over the previous year?

7. Ask about business models and customers

One of the distinctive features of the creative industries is their heterogeneity of business models. If, for example, you’re trying to measure disruption along the supply chain, you should ask from where businesses generate their income (e.g. through direct sales to consumers, sales to businesses, through online platforms, etc). Depending on the business model, it may also be useful to understand if the respondent primarily sells products, services, or both. Answers to these questions will help to understand where markets have broken down in these sectors.

8. Think about the impact

In asking respondents to think about the impact of the crisis, remember that this is a very uncertain time, so good estimates – for instance of loss of revenue – are the best you will be likely to get. Capturing the number of staff who have been laid off, had freelance contracts terminated, and/or been furloughed will be important. You may also wish to ask whether the business is functionally operating (through people working from home) or whether it has paused operations. It is also important to distinguish between impact to date and anticipated impacts. The former will be more accurate as it’s based on what has already happened, but will miss longer term expectations (and fears) about the consequences of the crisis. It is difficult for people to project into the future, so it’s vital to put clear time frames on these questions e.g. in the next six months / twelve months / three years.

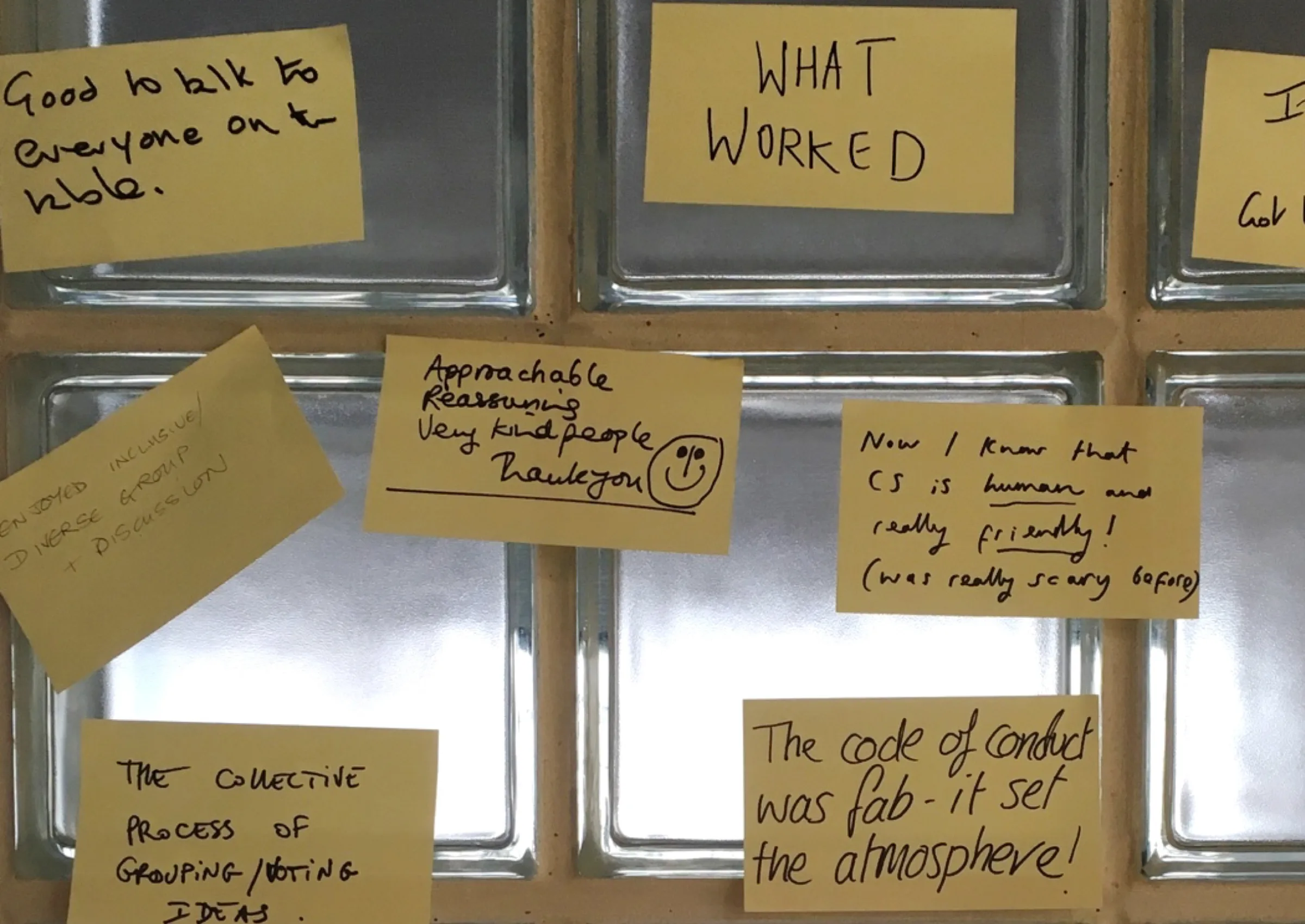

9. Measure reactions to policy changes

In a fast moving situation policymakers will need timely information on how creative businesses perceive the different measures that the government is introducing, what is seen as working and where there may be shortcomings. Trade bodies collecting survey data should view the exercise as a dynamic exercise and part of an ongoing dialogue with their sector.

10. Build a comparable evidence base by asking standardised questions

Evidence on how businesses are responding to COVID-19 is more useful if surveys ask standardised questions, as it allows the findings to be compared with others. For that reason, you should consider reusing questions from other surveys. It may also be worth joining up with other organisations on survey initiatives. Assessing the business impacts of COVID-19 will be challenging if there is a proliferation of survey findings that are not comparable. The PEC have collated a list of live and complete surveys from across the sector.

Good and timely survey data are essential to help us track the evolving impacts of the crisis and how policymakers can best support businesses. We hope the tips we have shared here are useful. If you have any questions, please don’t hesitate to contact Josh Siepel.

Photo by Joanna Kosinska

The PEC’s blog provides a platform for independent, evidence-based views. All blogs are published to further debate, and may be polemical. The views expressed are solely those of the author(s) and do not necessarily represent views of the PEC or its partner organisations.

Related Blogs

Taking stock of the Creative Industries Sector Plan

We summarise some of the key sector-wide announcements from the Creative Industries Sector Plan.

Why higher education matters to the arts, culture and heritage sectors

Professor Dave O’Brien, Professor of Cultural and Creative Industries at University of Manches…

What does the 2025 Spending Review mean for the creative industries?

A read out from Creative PEC Bernard Hay and Emily Hopkins On Wednesday 11th June the UK Government …

Bridging the Imagination Deficit

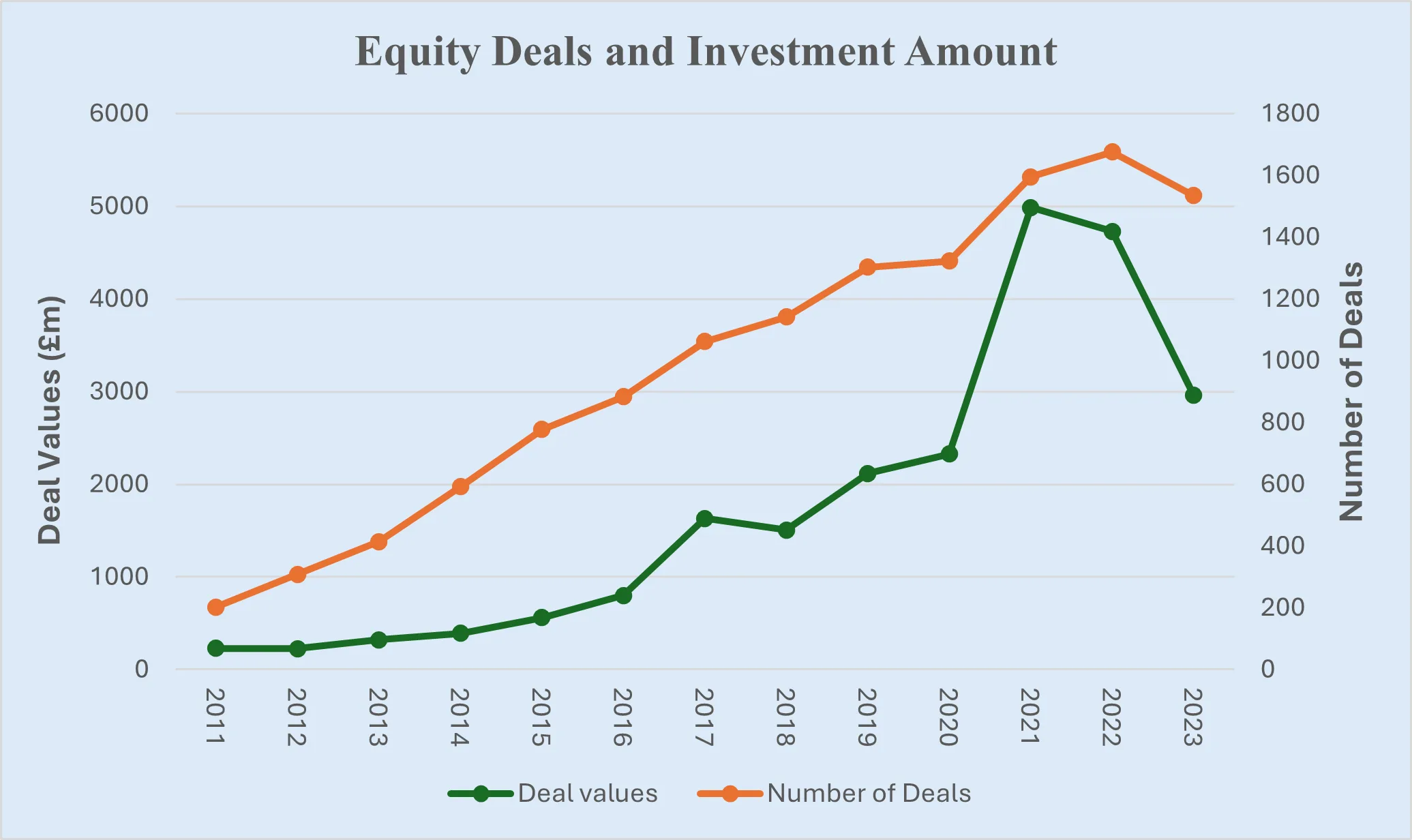

The Equity Gap in Britain’s Creative Industries[1]. by Professor Nick Wilson The creative industries…

Why accredited qualifications matter in journalism

Journalism occupations are included on the DCMS’s list of Creative Occupations and, numbering around…

All Together Now?

Co-location of the Creative Industries with Other Industrial Strategy Priority Sectors Dr Josh Siepe…

The Mahakumbh Mela, India, 2025

The festival economy: A Priceless Moment in Time Worth GBP 280 Billion in Trade Jairaj Mashru looks …

Class inequalities in film funding

Professor Dave O’Brien, University of Manchester, Dr Peter Campbell, University of Liverpool and Dr …

Creative self-employed workforce in England and Wales

Dr Ruoxi Wang, University of Sheffield and Bernard Hay, Head of Policy at Creative PEC Self-employed…

What just happened to funding for culture in Scotland?

First the facts: Creative Scotland announced the outcome of its new Multi-Year Funding Programme on …

Copyright and AI – a new AI Intellectual Property Right for composers, authors and artists

Background The new technology landscape emerging from the super rapid progress in developing AI, Gen…