The creative industries are a vital part of the UK economy. There are, however, some continued challenges that limit the sector’s growth.

Yesterday’s Spring Budget addressed a number of these critical issues, with some sector specific interventions and some more general policy announcements which will be important to the creative industries. Whilst this budget specifically mentioned the sector more than many previous budgets have, there remained some relevant matters which were not remarked on. Here, we highlight those areas that were both addressed in the budget and where we have published evidence that shows policy intervention could support growth in the creative industries, and report how this Budget seeks to address those recommendations.

Creative Industries as an innovation-powered UK sector

The creative industries generate £115.9bn in gross value added (GVA), nearly 6% of the British economy, and employ 2.3 million people, as well as contributing greatly to the country’s status internationally. The PEC has long made the case for the importance of the creative industries as a knowledge intensive, innovative sector, growing at twice the rate of the overall economy. For example, we have highlighted how many creative businesses are already investing in research and development (R&D) and how emerging technologies like AI may offer commercial and artistic opportunities to the sector.

In the Spring Budget, the Chancellor of the Exchequer acknowledged the creative industries as a sector of strategic importance to the UK economy and their capacity for innovation.

The Budget announced: The government has now asked Sir Patrick to report on how regulators can better support innovation, and the government’s new Chief Scientific Adviser, Professor Dame Angela McLean, will oversee future reviews into creative industries, advanced manufacturing, and the regulator growth duty. […] The government will turn its vision for UK enterprise into a reality by supporting growth in the sectors of the future. There are opportunities to accelerate the progress of the technologies that will define this century by encouraging investment and smarter regulation. This will support the government’s aim to capture a share of growing global markets in:

- green industries

- digital technologies

- life sciences

- creative industries

- advanced manufacturing

Research and development (R&D) tax relief

In its UK Innovation Strategy, the Government restated its commitment to increase public research and development (R&D) spending from around £15 billion per year to £22 billion per year by 2026/7. It is important that the creative industries participate in this, as maintaining high levels of innovation requires investment into R&D. However, there are high risks for companies investing in R&D, and positive spillovers to non researching firms – both of which mean that companies tend to spend too little on R&D. By addressing these potential barriers to the creative industries, the Government can create the conditions for supercharging economic growth.

Based on evidence the PEC recommended:

An R&D tax relief that works better for the UK’s creative industries, and in particular the use of an R&D definition which doesn’t disadvantage the creative industries.

The Budget announced: At Autumn Statement 2022, the government announced that from 1 April 2023 the rate of the Research & Development Expenditure Credit (RDEC) would be increased from 13% to 20%. […] The government also committed to considering the case for further support for R&D intensive SMEs. From 1 April 2023, the government will introduce an increased rate of relief for loss-making R&D intensive Small and Medium size Enterprises (SMEs). Eligible companies will receive £27 from HMRC for every £100 of R&D investment. The government remains committed to supporting R&D, and recognises the important role that R&D and innovation play for the economy and society.

Other interventions relating to the R&D tax relief included a higher rate of relief for loss-making R&D intensive SMEs, and a delay to overseas expenditure for R&D tax reliefs.

Audio visual tax relief

PEC research shows how the Film, TV and Games sector are important to the UK economy as a vital part of the creative industries export base. We have also suggested how intense the international competition is to attract foreign direct investment in this area. To support the sector, the government undertook a consultation on reforming audio-visual creative tax reliefs to incentivise the production of UK based content and support the growth of the audio-visual sectors, which the PEC welcomed.

The Spring Budget announced the reform of the audio-visual tax relief scheme.

The Budget announced: The government will continue to support the UK’s world-leading creative industries by reforming the audiovisual tax reliefs into expenditure credits with a higher rate of relief than under the current system.[…] The expenditure threshold for high-end TV will remain at £1 million per hour. Following a public consultation, the film, TV and video games tax reliefs will be reformed, becoming expenditure credits instead of additional deductions from 1 April 2024. The new Audio-Visual Expenditure Credit will replace the current film, high-end TV, animation and children’s TV tax reliefs. Film and high-end TV will be eligible for a credit rate of 34% and animation and children’s TV will be eligible for a rate of 39%. The expenditure threshold for high-end TV will remain at £1 million per hour. The new Video Games Expenditure Credit will have a credit rate of 34%. Qualifying expenditure for the Video Games Expenditure Credit will be expenditure on goods and services that are used or consumed in the UK. Games that have not concluded development on 1 April 2025 may continue to claim EEA expenditure under the current video games tax relief until this relief sunsets in April 2027.

Arts funding

PEC research found that the arts contribute directly to the economy, and can be important for health and wellbeing. They can help people love the place they live in and also help to shape the global view of the UK. These myriad benefits link to many policymakers’ objectives for public money, whether that is funding to support innovation, unlock health benefits or make us proud of the places we live in. That is why policymakers at all levels, from those in international bodies (like UNESCO), to national governments, to local policymakers, have historically invested in the arts. PEC research has also highlighted how, despite these very public benefits, public expenditure on the arts in England has fallen by more than 30% in real terms between 2009/10 and 2019/20, and has shown how important Theatre, Orchestra and Museums tax reliefs have been in replacing lost funding.

The Budget announced: Extending the higher rates of Theatre Tax Relief (TTR), Orchestra Tax Relief (OTR) and Museums and Galleries Exhibitions Tax Relief (MGETR) for 2 years – The temporary higher headline rates of relief for TTR, OTR and MGETR will be extended so that from 1 April 2023, the headline rates of relief for the TTR and the MGETR will remain at 45% (for non-touring productions) and 50% (for touring productions). OTR rates will remain at 50%. From 1 April 2025, the rates will be 30% and 35%, and on 1 April 2026 the headline rates of relief for TTR and MGETR will return to 20% and 25%. The headline rates of relief for OTR will return to 25%.

Qualifying expenditure for theatre, orchestra, and museums and galleries exhibition tax reliefs will be changed to ‘expenditure on goods and services that are used or consumed in the UK.’ This will align the cultural reliefs with the audio-visual reliefs and ensure these reliefs remain compliant with the UK’s international obligations. Productions that have not concluded by 1 April 2024 may continue to claim EEA expenditure until 31 March 2025.

Levelling Up

The PEC’s research suggests that the creative industries can play a major role in ‘levelling up’ the UK economy. Nesta research has identified 47 creative clusters throughout the UK. As these creative clusters grew at twice the rate of their regional economy between 2010-17 and as each new job in the creative industries creates 2 additional non-tradable jobs in the local economy, this offers great opportunities for the creative industries to support levelling up. Evidence also suggests that the creative industries can deliver boosts to wellbeing and deliver pride in place. Our research has also identified 247 smaller ‘microclusters’ in places outside the largest cities traditionally associated with the sector. If nothing is done to support smaller clusters and microclusters, we estimate that three quarters of new employment up to 2030 would be in the top ten creative clusters, meaning the sector’s contribution to addressing the UK’s low productivity outside the Greater South East would be limited.

For the creative industries to support Levelling Up local decision making matters. There is growing consensus that if we are to do something for a place, it should also be of the place. PEC researchers have suggested, therefore, that ‘Levelling Up’ policy initiatives must take the particular needs and existing capacities of different places into account if there is any hope of creating a level policy playing field that equitably addresses social need and increases the health and wealth of the nation.

The Budget announced: The government is launching the refocused Investment Zones programme to catalyse 12 high-potential knowledge-intensive growth clusters across the UK, including 4 across Scotland, Wales and Northern Ireland. Each cluster will drive the growth of at least one of our key future sectors – green industries, digital technologies, life sciences, creative industries and advanced manufacturing – bringing investment into areas which have underperformed economically. […] Each cluster will drive growth in key future sectors and bring investment to the local area. Each English Investment Zone will have access to interventions worth £80 million over five years, including tax reliefs and grant funding. Spring Budget delivers on the Levelling Up White Paper by providing new and deeper powers to more local leaders. Trailblazer deals have been agreed with the Greater Manchester and West Midlands Combined Authorities which will give them greater control over local transport, skills, employment, housing, innovation and net zero priorities, as well as single funding settlements at the next Spending Review. The government will also negotiate a new wave of devolution deals with areas across England, which will include local investment funding for areas that are committed to electing a mayor or leader.

Hero Photo by Shane Rounce on Unsplash

Thumbnail Photo by Marlon Maya on Unsplash

Related Blogs

Taking stock of the Creative Industries Sector Plan

We summarise some of the key sector-wide announcements from the Creative Industries Sector Plan.

Why higher education matters to the arts, culture and heritage sectors

Professor Dave O’Brien, Professor of Cultural and Creative Industries at University of Manches…

What does the 2025 Spending Review mean for the creative industries?

A read out from Creative PEC Bernard Hay and Emily Hopkins On Wednesday 11th June the UK Government …

Bridging the Imagination Deficit

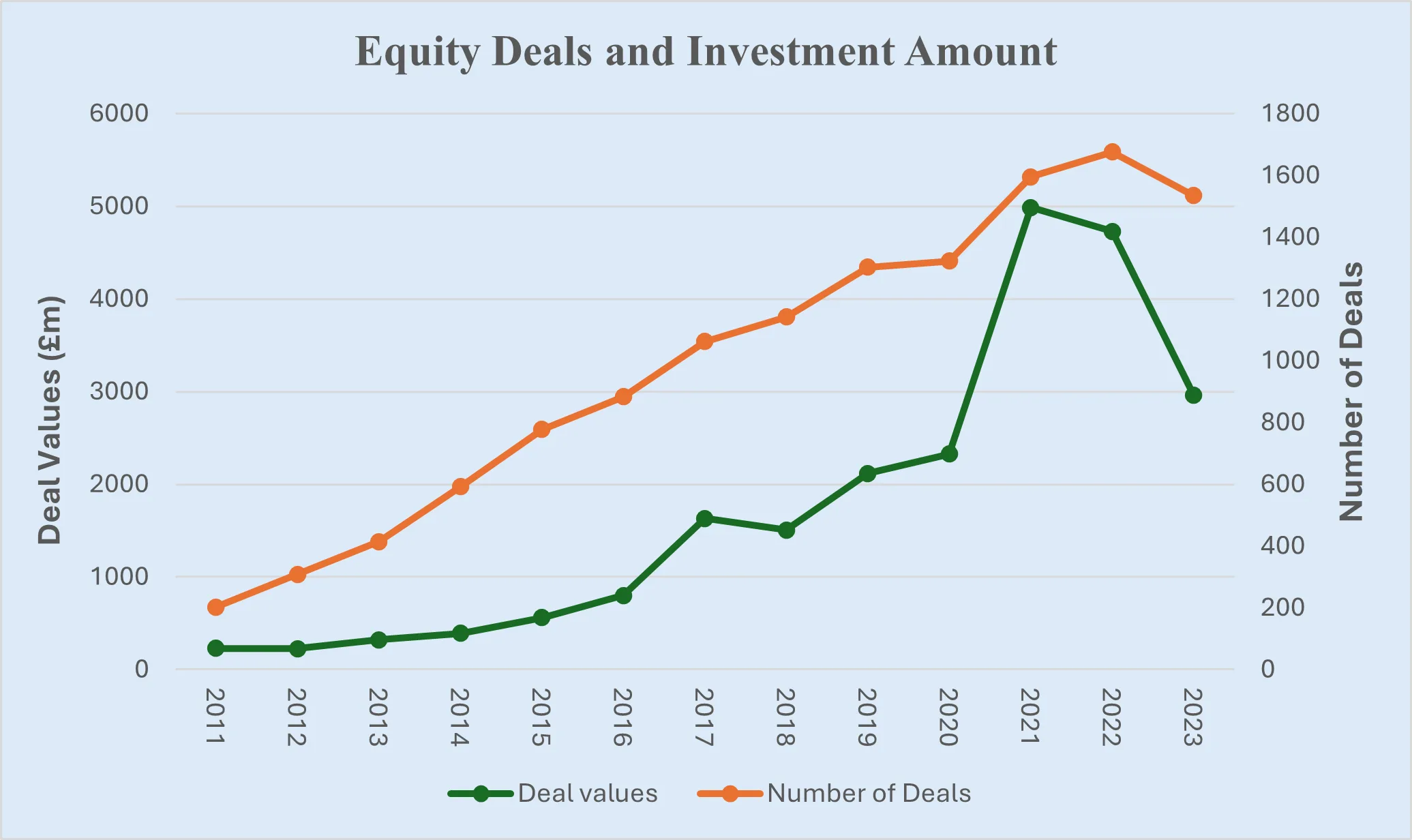

The Equity Gap in Britain’s Creative Industries[1]. by Professor Nick Wilson The creative industries…

Why accredited qualifications matter in journalism

Journalism occupations are included on the DCMS’s list of Creative Occupations and, numbering around…

All Together Now?

Co-location of the Creative Industries with Other Industrial Strategy Priority Sectors Dr Josh Siepe…

The Mahakumbh Mela, India, 2025

The festival economy: A Priceless Moment in Time Worth GBP 280 Billion in Trade Jairaj Mashru looks …

Class inequalities in film funding

Professor Dave O’Brien, University of Manchester, Dr Peter Campbell, University of Liverpool and Dr …

Creative self-employed workforce in England and Wales

Dr Ruoxi Wang, University of Sheffield and Bernard Hay, Head of Policy at Creative PEC Self-employed…

What just happened to funding for culture in Scotland?

First the facts: Creative Scotland announced the outcome of its new Multi-Year Funding Programme on …

Copyright and AI – a new AI Intellectual Property Right for composers, authors and artists

Background The new technology landscape emerging from the super rapid progress in developing AI, Gen…