Think about a creative cluster: What comes to mind? Creative clusters are the buzzing centres of the creative industries, where creative individuals and companies mingle, share ideas, and shape the innovative content and services that have made the UK creative industries successful. These clusters have been identified by the government as engines of driving the success of the creative industries, and investments such as the Creative Industries Clusters Programme have aimed to help build these clusters. So, if you were asked to think of a creative cluster, one might naturally think of the Northern Quarter in Manchester, Soho or Hoxton in London, or North Laine in Brighton. But what really makes a cluster?

In reality, identifying clusters is quite difficult. A lot of previous research on creative clusters tends to identify them at the city level. Indeed, Nesta’s highly influential 2016 report The Geography of Creativity in the UK identified 47 creative clusters in the UK that had higher concentrations of creative industries businesses, or higher levels of growth. These clusters are important, as from a policy perspective, supporting clusters is a means of addressing the stark regional differences in creative industries activity. Through its work, the PEC has been addressing these issues, in a number ways, including work on Covid, skills, and on the efficacy of regional development programmes. Through all of these, clusters are central.

The sorts of clusters that this work identifies – like Manchester, Glasgow and Brighton (where the economic impact of the cluster was documented in the seminal Brighton Fuse report) are clearly important for policymakers. But when most people think of creative clusters, they are much likely to think of the smaller areas, the Sohos, the North Laine and the Northern Quarters. Likewise, you don’t need to spend too much time looking at the creative industries before you realise that there are a lot of very interesting creative neighbourhoods and areas outside the big, well known creative districts. Look at Creative Folkestone in Kent, where a whole cultural district has built up a local creative ecosystem. Look at Plymouth, where academia sits alongside production and visual arts. These are highly creative areas, but to date they have not been fully visible in previous efforts to map creative clusters.

The PEC report published today identifies 709 of these distinct creative microclusters. These were identified using a big data exercise where we took scraped web data from 200,000 websites of creative industries organisations and ran an algorithm to identify where there were clusters of at least fifty creative industries organisations in an area. We see that these microclusters are spread widely across the UK. One-third are outside of the 47 major creative clusters that have widely been identified in the past. Building on this data exercise, we surveyed nearly 1000 companies in early 2020, to learn about how they operate and the challenges they face.

Are microclusters different to larger creative clusters?

In our report we try to understand the impact of being in a creative microcluster – that is, a creative neighbourhood, town or village – on how companies operate. We know from previous research that companies in creative clusters benefit from access to skills, knowledge, customers and lifestyle and amenities. For instance, we find that companies in microclusters, wherever they are, get more of their new ideas from within their town, city or village – often within a 20 minute walk of their office.

Being in a microcluster takes the biggest difference for companies located in microclusters outside the big, established creative clusters. These companies were more likely to want to grow, and more likely to have grown in the past year, than companies outside microclusters. They are more likely to behave like companies in the bigger, established creative clusters – benefitting from proximity to skills, customers and knowledge in particular. However, companies in microclusters outside of the South East were more likely to perceive access to external finance as a barrier to growth. This, combined with the growth ambitions and higher levels of growth previously, suggest that companies in microclusters have untapped potential for growth.

Are microclusters the future?

Our results show that microclusters are an important feature of the UK’s creative industries, not just in the most famous clusters but in cities, towns and villages around the UK. The challenge we face is how to better support creative businesses around the UK, in light of the enormous disruption from Covid and the uncertainty posed by Brexit for creative sectors. Many organisations will face depleted reserves and might have significant loans to pay. Previous research by the PEC has shown that following the financial crisis in the early 2010s the creative industries were increasingly concentrated in London and the South East. It is imperative that we do not allow history to repeat itself as we contemplate the shape of a post-Covid recovery. Helping the creative clusters to return to their pre-pandemic strength will require a combination of support for those businesses and workers whose work has been disrupted by the pandemic; building a diverse mix of businesses, individuals and arts organisations to provide the basis of new and innovative interactions; and providing support and opportunities for those businesses with growth ambitions pre-Covid to grow their businesses.

Our findings show several ways that these aims can be addressed. Our finding that microclusters are important engines for growth potentially shows the way for important placemaking activities across the UK. We also show that investments in supporting ambitious companies outside London and the South East are likely to pay substantial dividends. EU structural funds and Creative Europe have previously provided support in this area, and an equivalent UK fund could help to build on this progress. Moreover, the issues that companies in microclusters outside London and the South East of England perceive around access to finance point to the need for a sustainable funding ecosystem including both public and private capital, that supports growing creative companies across the UK.

The UK government has also supported a pilot of the Creative Scale-Up scheme, which has aimed to support creative businesses in Greater Manchester, the West Midlands and the West of England wishing to scale up. This scheme has supported both supply of capital, by engaging with potential investors to encourage and stimulate investment, and demand for capital, by providing support for businesses with growth ambitions to help these businesses to prepare to scale up their activities. Our results suggest that an extension of the Creative Scale-Up programme, perhaps in the forthcoming Spending Review, could allow other clusters to benefit, and could help to unlock the potential growth within microclusters that our work has identified.

Read the full report ‘Creative Industries Radar‘ and explore the map of creative clusters and microclusters in the UK.

Photo by Ryan Booth, taken of Newcastle upon Tyne, England.

Related Blogs

Research resources on Creative Clusters

We’ve collated recent Creative PEC reports to help with the preparation of your Creative Cluster bid…

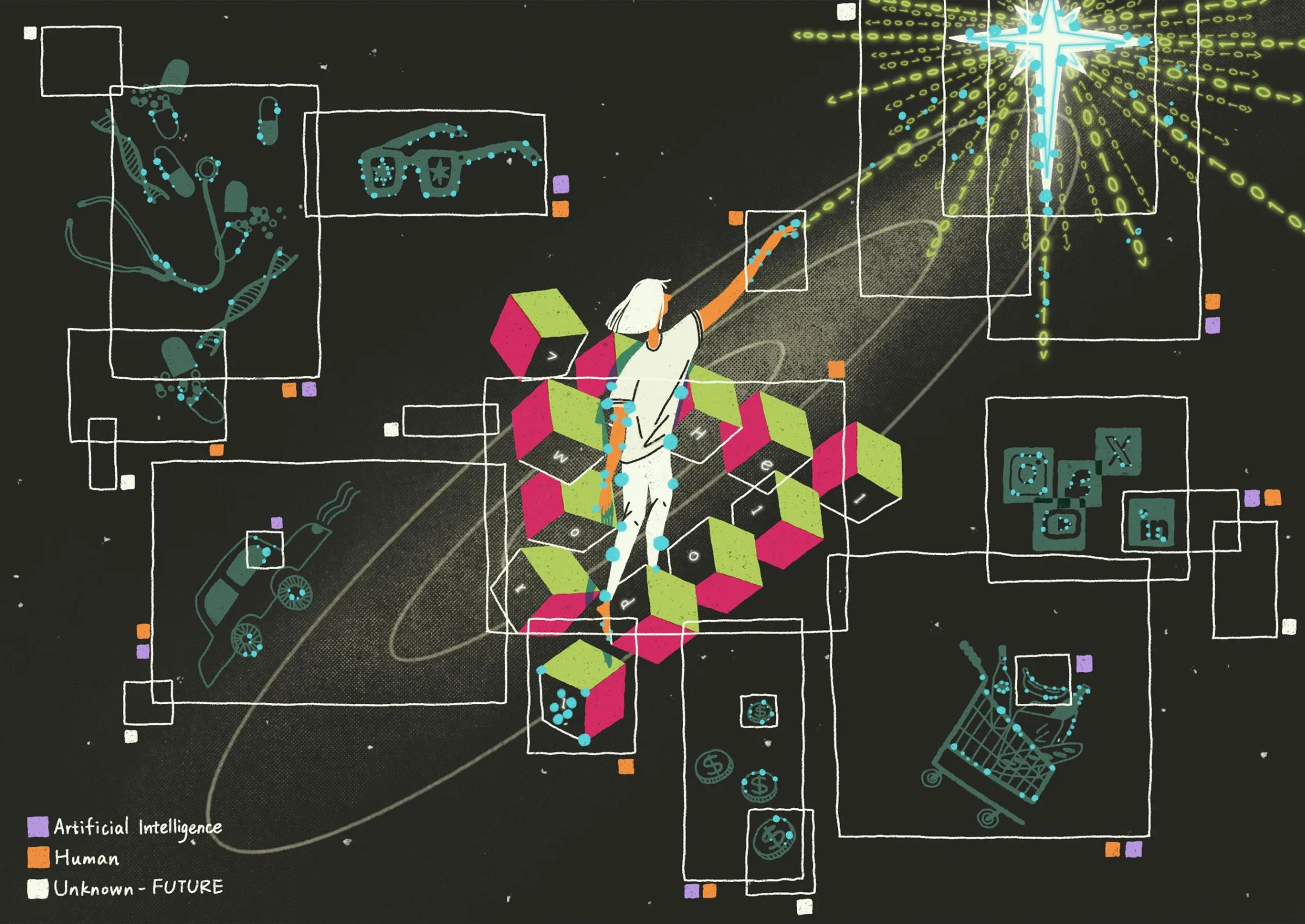

What UK Job Postings Reveal About the Changing Demand for Creativity Skills in the Age of Generative AI

The emergence of AI promises faster economic growth, but also raises concerns about labour market di…

Creative PEC’s digest of the 2025 Autumn Budget

Creative PEC's Policy Unit digests the Government’s 2025 Budget and its impact on the UK’s creative …

Why do freelancers fall through the gaps?

Why are freelancers in the Performing Arts consistently overlooked, unseen, and unheard?

Insights from the Labour Party Conference 2025

Creative PEC Policy Adviser Emily Hopkins attended the Labour Party Conference in September 2025.

Association of South-East Asian Nations’ long-term view of the creative economy

John Newbigin examines the ASEAN approach to sustainability and the creative economy.

Culture, community resilience and climate change: becoming custodians of our planet

Reflecting on the relationship between climate change, cultural expressions and island states.

Cultural Industries at the Crossroads of Tourism and Development in the Maldives

Eduardo Saravia explores the significant opportunities – and risks – of relying on tourism.

When Data Hurts: What the Arts Can Learn from the BLS Firing

Douglas Noonan and Joanna Woronkowicz discuss the dangers of dismissing or discarding data that does…

Rewriting the Logic: Designing Responsible AI for the Creative Sector

As AI reshapes how culture is made and shared, Ve Dewey asks: Who gets to create? Whose voices are e…

Reflections from Creative Industries 2025: The Road to Sustainability

How can the creative industries drive meaningful environmental sustainability?