While the dreaded no-deal scenario did not materialise when the UK left the EU single market and customs union in January 2021, many UK businesses are struggling to deal with the new UK-EU trade agreement, as it involves higher trade costs in the form of non-tariff barriers such as customs procedures, documentation requirements, and regulatory compliance. The UK’s creative industries (CIs), which are mostly represented by micro firms, usually financially constrained and less capable of quickly adjusting to trade shocks, are amongst those sectors most affected by these changes. There are also concerns of a decreased ability to retain foreign creative skilled labour, which constitutes a key driver of growth and innovation in the country. In recent months, for example, there have been growing concerns of a crisis of the UK fashion and textile industry. The EU is by far the largest trade partner for the UK’s CIs and accounts for more than 70% of UK fashion and textile exports. Increased costs, administrative burdens, and delivery delays seem to be now creating severe disruption to the UK-EU trade, with fashion businesses losing EU clients and some planning to establish distribution warehouses and branches in the EU at the expense of UK jobs.

In our research, we show that the uncertainty over trade policy between the UK and EU – which started in the wake of the 2016 referendum – had already affected a significant number of firms amongst UK textile and apparel manufacturers, fashion designers and retailers. Relying upon data from an original survey carried out between June 2019 and January 2020 with around 700 firms, we find that the Brexit shock had consequences for more than 60% of both firms operating upstream (manufacturers) and downstream (fashion designers/retailers) of this value chain.

Several firms affected by Brexit indicated market uncertainty, associated with the sterling’s depreciation, as a major contributing factor. Increased costs of imports, delivery and overheads resulted in higher prices of domestic production. Respondents pointed out a downturn in retail sales, following a substantial reduction in the purchasing power of UK customers, with several brands and high-street shops shutting down. Some respondents claimed to have experienced a slowdown of their businesses, with a reduction in profitability, investments and labour force, confirming the fears about creative migrant workers returning to their home countries.

Some responses were:

- “We are now experiencing extreme difficulties in keeping the company going. We have had to lay people off and make redundancies”

- “I have had no applications from European workers which I have had over the last 20 years in business”

- “Workers have started moving back, labour force is depleting, and skilled labour is going”

Among fashion designers and retailers, some firms mentioned a decrease in orders from UK buyers, changes to delivery plans, delayed purchasing decisions and a reduced ability to plan in advance and meet the demand of new potential European and overseas customers. Several respondents claimed to have already applied (or planned to apply) changes to their supply and distribution networks. For example, some of the replies were:

- “We moved all production to the UK in light of Brexit to make us a 100% British brand”

- “To keep my own prices down for the customer I have undertaken a dynamic pricing strategy and I will be moving future manufacture to Portugal or Italy rather than remaining within the UK”

- “We used to have a small production in the UK. Brexit sealed the end of this collaboration”

Only 3 per cent of firms stated to have been positively affected by Brexit with an increase in sales particularly to the EU and US.

Overall, fashion design and retail firms appeared to be seriously concerned about the possibility of seeing jeopardised their trading relationships with European and international partners. These concerns were reinforced by the awareness of the lack of a large pool of domestic manufacturers with adequate technical skills, specialist expertise, and machinery as well as of firms allowing production in small batches. Before the signing of the new deal, especially micro-sized firms expressed fears about their future inability to trade with the EU. Examples of responses were:

- “I am worried about losing the ease of trading which exists at the moment”

- “We have had to reduce our product offering to items that can be UK sourced because we are a too small a company to cope with the red tape of importing”

- “Those who cannot source the materials that we need for our garments from the UK are stuffed”

In turn, manufacturing firms declared to have witnessed a significant decrease in orders from UK fashion designers and retailers, who have become extremely cautious and have started relying on less expensive and lower-quality products. Several firms indicated either to have lost large retailers that have offshored production or to have planned to move plants or warehouses to an EU country. Others declared to have stocked up on raw materials, experienced increased foreign competition and postponed investment plans such as expansion and innovation-related expenditures. Only 4 per cent of manufacturers witnessed a positive effect, experiencing for example an increase in turnover due to additional orders from UK retailers who sought to source more products in the UK to avoid potential difficulties with foreign suppliers.

While our findings show how Brexit affected the fashion and textile industry before the new UK-EU trade deal was signed, recent evidence confirms the overwhelmingly negative consequences for the sector also in the post-Brexit scenario. It is clear that, in the months and years ahead, firms operating upstream and downstream of the value chain will have to deal with minor and major changes to their trade exchanges and production networks. Several survey respondents mentioned the general perception of a lack of concrete action by the government to support the viability of the industry. Now more than ever, it is vital to help the sector to thrive and continue trading with the EU.

In an open letter to the UK’s Prime Minister, Fashion Roundtable, a think tank and trade association, has asked for a simplification of the post-Brexit trading regime. Moreover, it has called for a recognition of the sector within the government’s conversations and for financial support for the plethora of micro firms that cannot anymore afford to trade with the EU. In addition to sustaining this line, policy support is particularly crucial to help the manufacturing sector, which in the long-term might face both an increase in domestic demand and a drastic reduction in linkages with foreign firms. Investments in developing new skills and capabilities, upgrading product quality and production standards, as well as entering new production phases of the value chain would boost the confidence of those UK fashion designers and retailers that have seen their supply networks disrupted by new red tape, and now need to source some production components or products domestically to remain internationally competitive. The definition of a long-term sector-specific trade strategy, including for example support in exhibiting at trade shows or niche events in key overseas markets or in making domestic fairs and events more appealing to an international audience, will be also vital to promote exports and encourage inward investments in the sector by reinforcing the UK’s role as a fashion and textile hub.

This blog post is based on the article: Casadei P & Iammarino S (2021) Trade policy shocks in the UK textile and apparel value chain: Firm perceptions of Brexit uncertainty. Journal of International Business Policy.

Image by Ksenia Chernaya

The PEC’s blog provides a platform for independent, evidence-based views. All blogs are published to further debate, and may be polemical. The views expressed are solely those of the author(s) and do not necessarily represent views of the PEC or its partner organisations.

Related Blogs

When Data Hurts: What the Arts Can Learn from the BLS Firing

Douglas Noonan and Joanna Woronkowicz discuss the dangers of dismissing or discarding data that does…

Rewriting the Logic: Designing Responsible AI for the Creative Sector

As AI reshapes how culture is made and shared, Ve Dewey asks: Who gets to create? Whose voices are e…

Reflections from Creative Industries 2025: The Road to Sustainability

How can the creative industries drive meaningful environmental sustainability?

Creating value: the creative economy beyond culture by Marta Foresti

Marta Foresti explains the value of international cooperation as she becomes Chair of the GCEC.

Taking stock of the Creative Industries Sector Plan

We summarise some of the key sector-wide announcements from the Creative Industries Sector Plan.

Conversations between the Global North and South

Unsettling and reordering the creative economy

Why higher education matters to the arts, culture and heritage sectors

Professor Dave O’Brien, Professor of Cultural and Creative Industries at University of Manches…

What does the 2025 Spending Review mean for the creative industries?

A read out from Creative PEC Bernard Hay and Emily Hopkins On Wednesday 11th June the UK Government …

Bridging the Imagination Deficit

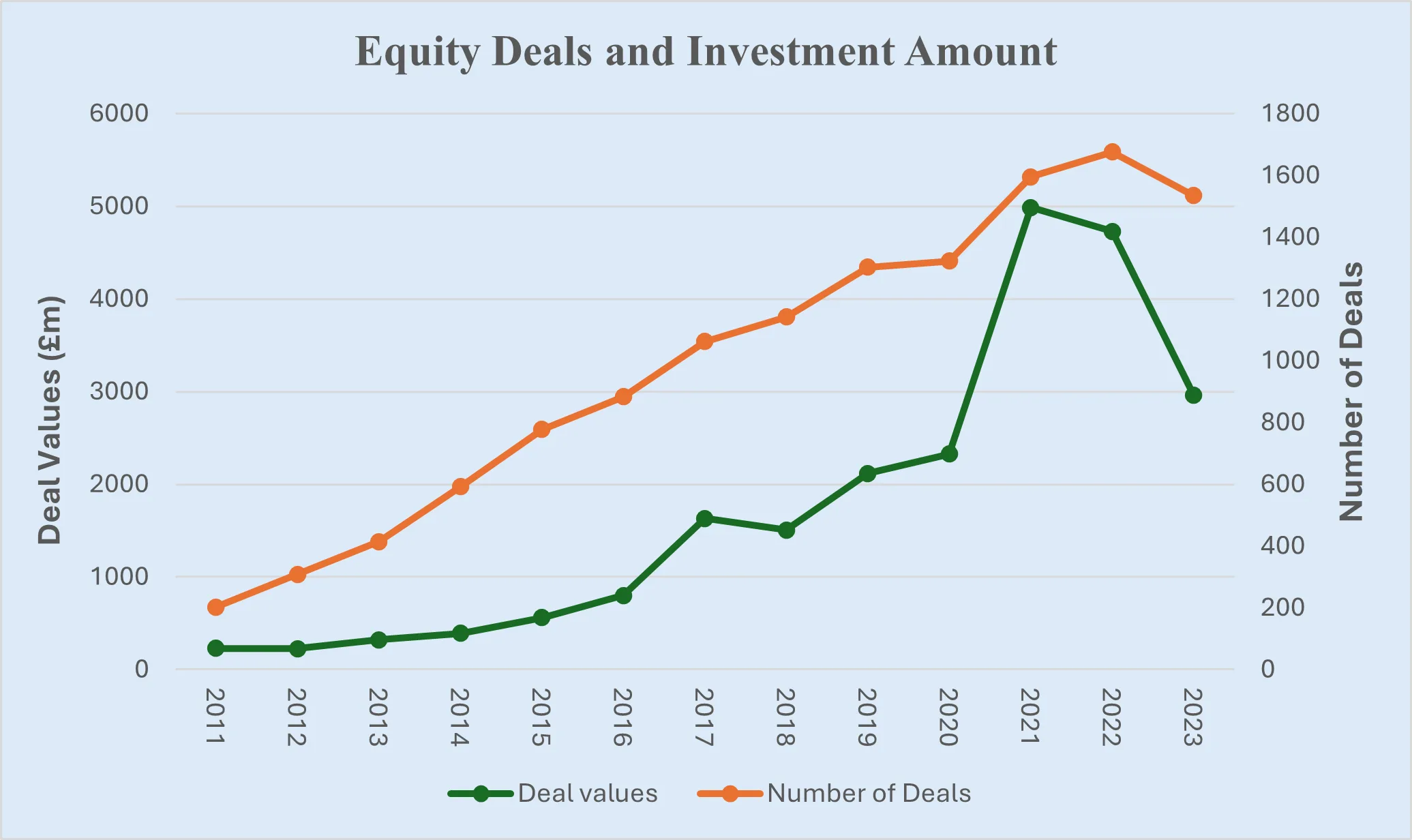

The Equity Gap in Britain’s Creative Industries[1]. by Professor Nick Wilson The creative industries…

Why accredited qualifications matter in journalism

Journalism occupations are included on the DCMS’s list of Creative Occupations and, numbering around…

All Together Now?

Co-location of the Creative Industries with Other Industrial Strategy Priority Sectors Dr Josh Siepe…

The Mahakumbh Mela, India, 2025

The festival economy: A Priceless Moment in Time Worth GBP 280 Billion in Trade Jairaj Mashru looks …